Our Next Webinar

Fintech Investment Opportunity with Sequure:

16:00 GMT – 12th December 2023

Investment Opportunity

SEQUURE is a new UK based fintech platform, connecting investors in Europe with US commercial real estate fund opportunities, effectively solving compliance, due diligence, and tax complexities across multiple jurisdictions.

- A seed investment of $650,000 is expected to deliver an EBITDA margin of 61% and a net margin of 44% by year 5, with significant free cash flow from year 4 for capital allocation to new opportunities or shareholder return.[1]

- SEQUURE’s founders have committed capital of $500,000 to create a working fintech platform.

Financial Highlights | |||||

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 |

Revenue | $1,996,000 | $2,321,000 | $2,646,000 | $4,930,000 | $7,052,000 |

EBITDA | $67,500 | $59,200 | $31,400 | $2,287,400 | $4,367,400 |

EBITDA Margin | 3% | 2% | 1% | 46% | 61% |

FCF | -$831,298 | -$101,651 | -$152,087 | $892,769 | $2,640,585 |

Source: SEQUURE, Equidam.com

- Based on the forecast performance, a pre-money valuation of between $5.1 million and $6.7 million is achievable, given the inherent operating leverage in the business model.

- The following pre- and post-money valuations are based on a weighted average of 5 valuation models. The $650,000 seed investment is 9% of mid-point post-money valuation.

SEQUURE Valuation[2] | |||

| Low Bound | Mid-point | High Bound |

Pre-money | $5,115,000 | $5,895,072 | $6,675,000 |

Post-money | $5,765,000 | $6,545,072 | $7,325,000 |

Source: SEQUURE, Equidam.com

Unique Opportunity

Founded in 2023, SEQUURE is a pre-revenue, development stage business that is deploying proven and scalable technology.

Led by co-founders CEO Robin Booth and CTO Linden Booth, SEQUURE has an experienced management team, capable of delivering a high-quality technology platform. SEQUURE has 6 employees and is a private limited company incorporated under the laws of England and Wales.[3]

SEQUURE intends to use the $650,000 seed capital investment as follows:

- Operations: $299,975 (46%)

- General expenses: $150,020 (23%)

- Sales and Marketing: $99,970 (15%)

- Product and R&D: $99,970 (15%)

The expected launch date for the SEQUURE platform is Q1 2024, subject to FCA authorisation.

SEQUURE earns revenue through fund management and performance fees, with the majority of revenue linked to successful investor returns. SEQUURE believes breakeven can be achieved in year one once underlying fund investments reach $60-80MM (depending on fund terms). Shareholder profits are expected to scale from year four as funds start exiting and profit share carry is paid out.

Company Overview

SEQUURE is a specialist fintech platform providing a compliant pathway for non-US investors to access US commercial real estate (CRE) mid-market funds. The company will source top tier US CRE managers and ensure institutional level structuring for tax efficiency. SEQUURE operates under FCA authorisation in the UK.

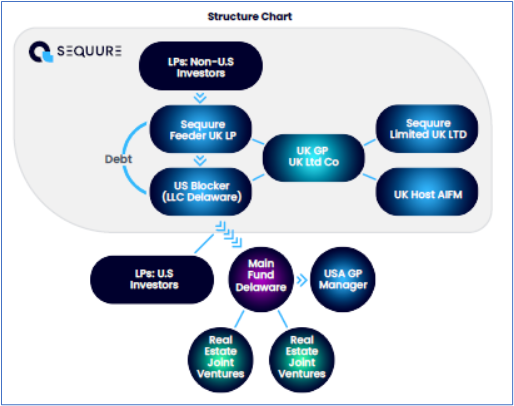

SEQUURE’s Feeder Fund Structure with US Tax Blocker Entities solves the complexity of investing into US-CRE funds for sophisticated global investors. The SEQUURE platform can be scaled with additional investment offerings and operate across new jurisdictions. SEQUURE is independent and does not accept any fees from fund managers on its platform.

SEQUURE’s fund selection process combines due diligence, ongoing monitoring, and expert evaluation. The company conducts in-depth research and analysis for each potential fund, examining the track record, strategy, and compliance history of potential managers. SEQUURE also assesses alignment with investors objectives and risk tolerance.

SEQUURE believes there are two main competitors, Moonfare and Troviq Private Markets, though these are focused on private equity funds. SEQUURE is focused on US Mid-Market CRE funds, with a total addressable market estimated to be $30 billion of potential AUM.[4] [5]

[1] All figures US dollars.

[2] Valuation report and spreadsheet available in the data room.

[3] https://find-and-update.company-information.service.gov.uk/company/14993308